In the world of financial investments, leverage is a double-edged sword due to its multiplier effect on both gains and losses. In good times when the market is bullish, highly leveraged investors are able to boost their returns considerably but when the market is bearish, these investors would find themselves extremely vulnerable due to the significant exposure levels of their portfolio. The dangers of excessive leverage is illustrated by the 1929 stock market crash which was caused primarily by the then skyhigh leverage ratio of the stock market. At that time, the practice of margin trading which operates using the same principle as leverage was unregulated.

(2) Of Leverage Ratios and Market CrashesHaving learnt its lessons from the crash, the U.S government introduced the Securities Act of 1933 and the Securities Exchange Act of 1934 to regulate the practice of margin trading whereby these regulations helped control the leverage ratio of the stock market. In the context of the crypto market, the use of customers’ deposits by crypto entities to facilitate their crypto lending services is also a form of market leverage.

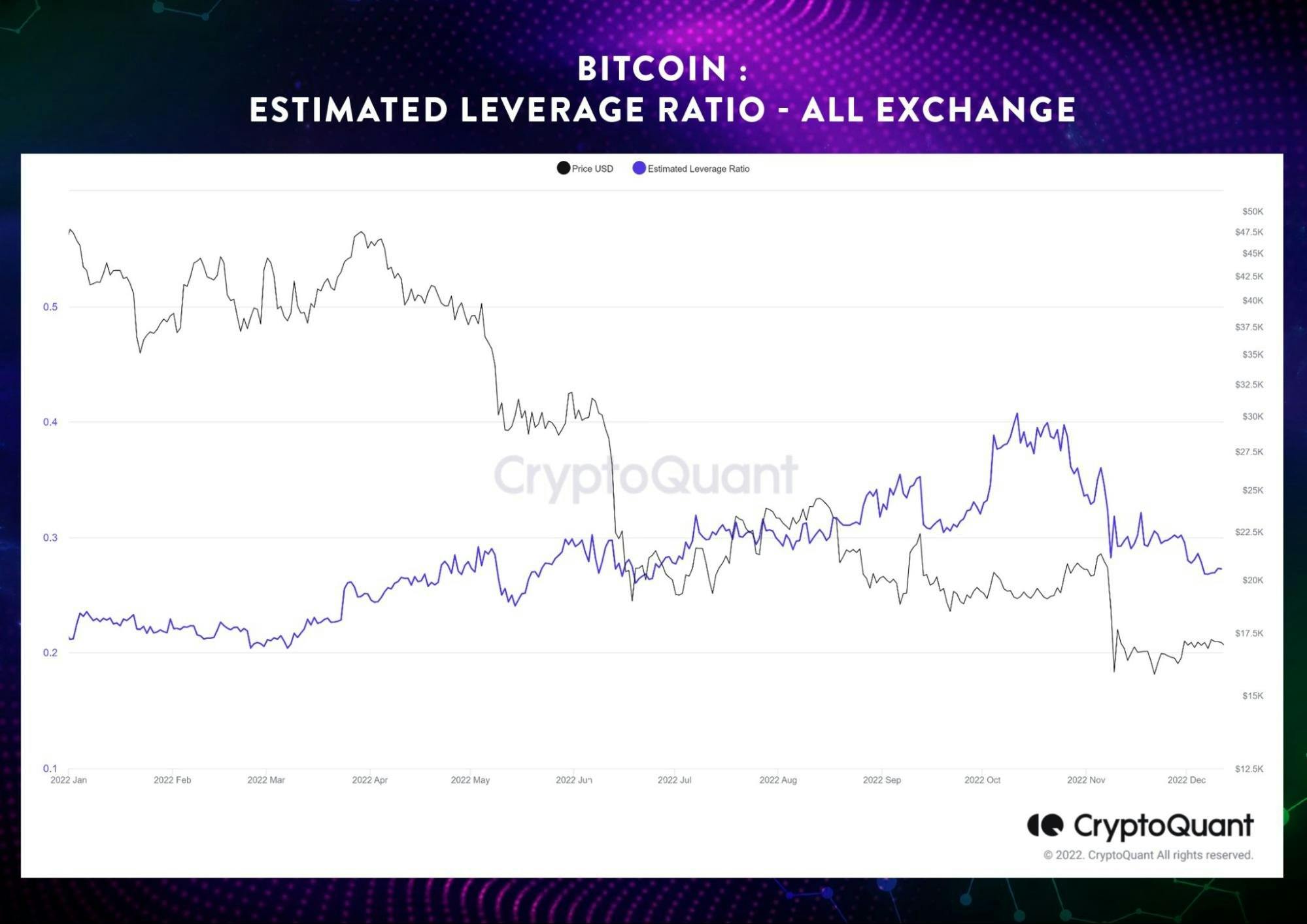

The dangers of this are illustrated by the fact that the notable crypto dominoes which have fallen in the wake of the collapse of TerraUSD and the FTX fallout are those which provide crypto lending services. These included Voyager, Celsius Network, Babel Finance and BlockFi. In this regard, it is notable that data indicates there was a significant drop in the leverage ratio of Bitcoin immediately after the FTX fallout.

As Bitcoin is the flagship cryptocurrency, it is generally used for leveraging by crypto investors. Hence, the leverage ratio of the crypto market is premised on the leverage ratio of Bitcoin. On 6 November 2022, the estimated leverage ratio of Bitcoin was 0.34 but in the aftermath of the FTX fallout this dropped to 0.29 just ten days later on 15 November 2022. In simple terms, this could mean either (1) a significant amount of debt in the crypto market has been liquidated or (2) the value of assets in the crypto market has increased considerably. As the reduction of 0.5 in the leverage ratio of Bitcoin occurred in the aftermath of the FTX fallout, (1) is more likely to be the underlying cause of the drop in leverage ratio as the value of crypto assets including Bitcoin has dropped during the relevant period.

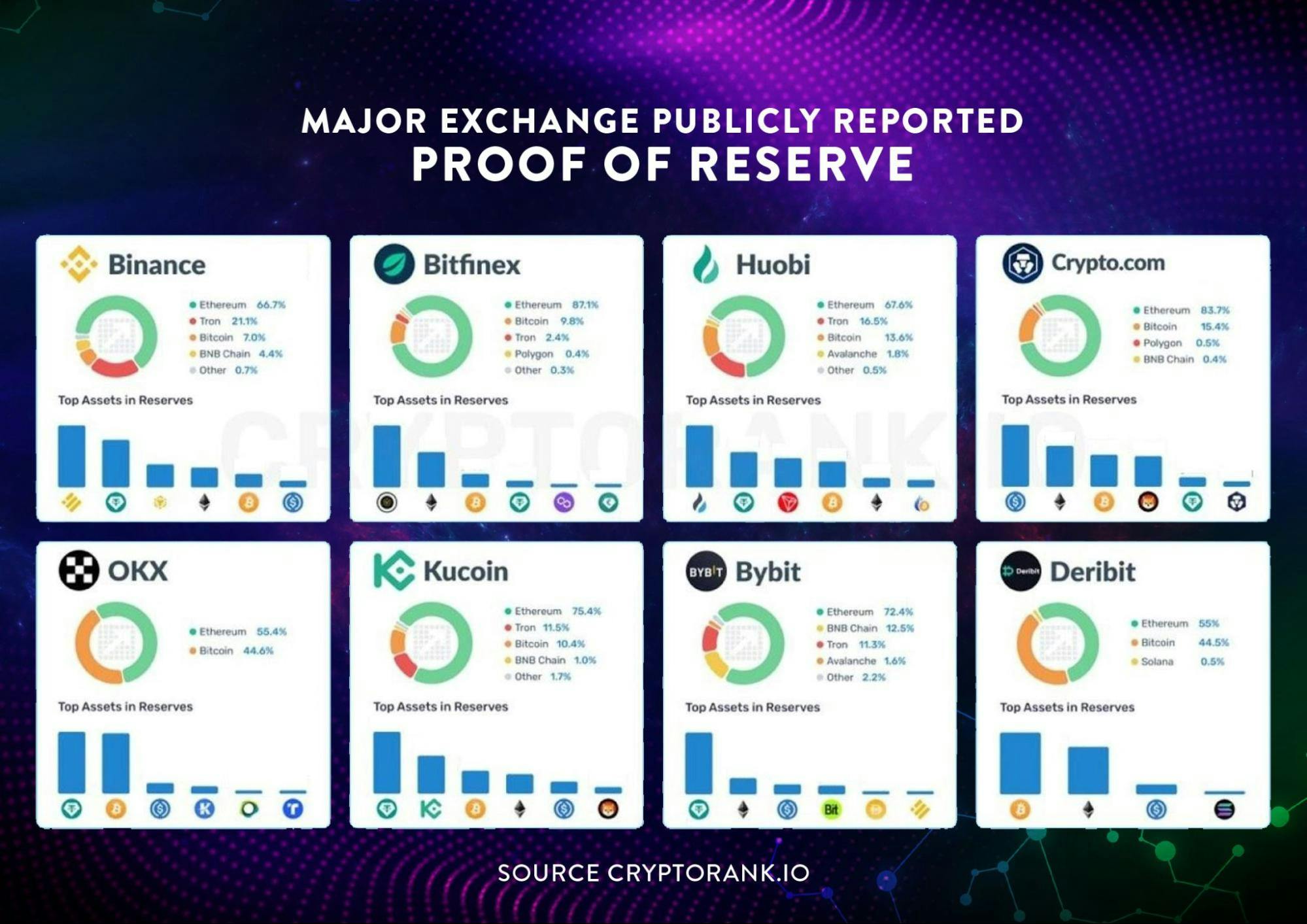

Whilst we await the introduction of regulations to control the leverage ratio of the crypto market, CEXs have taken the initiative to restore investor confidence in the market by introducing Proof-of-Reserves (PoR). One of the objectives of PoRs is to ensure that customers’ assets holdings are held as deposits instead of being used for other purposes, thereby safeguarding these assets while reducing the leverage ratio of the crypto market which in turn makes it less volatile i.e. more stable.

(a) What are PORs, its objectives and limitations?The PoR verification process involves the use of cryptography for the audit of the financial health of CEXs by verifying the balance of their customers’ accounts through the following methods:-

(i) Cryptographic message signing which involves crypto exchanges providing information about its reserves by releasing unique cryptographic messages and the exchange’s public keys. Customers and auditors can then use the public keys to verify the authenticity and integrity of the messages. The information in the verified messaged will in return help confirm whether the exchange holds the amount of crypto currency it claims to have;

(ii) Instructed movement of funds which involves moving a specific amount of funds from the exchange’s wallets to a designated address at a specific time. The designated address in this case can be the auditor’s wallet. This test is important to show that the exchanges have control over the reserves and ultimately cover customer withdrawals.:- and

(iii) Address searches on blockchain explorers such as EtherScan and BscScan to verify the addresses tagged to a CEX. This involves the use of open source blockchain explorers to warrant the transparency of the balances in the customers' accounts of the CEX which is being audited.

The limitations of PoRs are that they:-

(i) Only cover the balance of customers’ accounts at the relevant time when the financial audit is conducted. In times of high market volatility, there may be a need for more frequent financial audits of PoRs;

(ii) Should not be taken as a silver bullet for the problem of trust issues in CEXs notwithstanding the fact that the PoRs are subjected to financial audits. This is because the financial audits of the PoRs of CEXs are not undertaken as assurance engagements which means that the results of the audits do not amount to an assurance conclusion. (See for example the financial audit report issued by Mazars for Binance’s PoR (which has since been removed from public view after Mazars decided to suspend the provision of its financial audit services for crypto companies including Binance, Crypto.com and KuCoin) provides that “This (Agreed-Upon Procedures) AUP engagement is not an assurance engagement. Accordingly, we do not express an opinion or an assurance conclusion”

On the assumption that the terms of engagement for the financial audit of Binance’s PoR is a common standard for the financial audits of the PoRs of other CEXs, this effectively means that the financial audit results of the PoRs of CEXs do not amount to “a conclusion designed to enhance the degree of confidence of the intended users other than the responsible party about the outcome of the evaluation or measurement of a subject matter against criteria”:

In essence non-assurance engagements refers to "engagements that do not meet the definition of an assurance engagement." To put it simply, any reliance by third parties on the findings of a non-assurance engagement would be at their own risk as there may be limited liability protection, lower levels of independence and accuracy compared to an assurance engagement:- and

(iii) “Don’t include accounts with negative balances” as pointed out by the departing CEO of Kraken, Jesse Powell in relation to Binance’s PoR. According to Powell, the scope of Binance’s financial audit process is incomplete as it “didn't include accounts with negative balances. The statement of assets is pointless without liabilities.“ In response, co-founder and CEO of Binance, CZ asserted that there is no such thing as “negative balance” in a PoR. The jury is still out.

Negative balances refer to the accounts in which cryptocurrencies which are owed by the CEX to its customers i.e. form part of the short term liabilities of the CEX. The omission of negative balances renders the appraisal of the financial standing of the CEX which is being audited to be incomplete as these balances are necessary for financial auditors to calculate the liquidity coverage ratio of CEXs. Liquidity coverage ratio refers to “the proportion of highly liquid assets held by financial institutions, to ensure their ongoing ability to meet short-term obligations." To put it simply, the omission of negative balances means the public does not have a full picture of the exchange's financial positions and ultimately this creates uncertainty over the exchange’s full ability to cover customer withdrawals.

Notwithstanding its shortcomings, PoR is a step in the right direction for CEXs towards enhancing their transparency levels whereby this step is imperative in view of the custodial nature of their services particularly in the wake of the FTX fallout.

(b) Which CEXs are leading the way for PoRs?As at the time of writing, a total of 10 exchanges have published their PoRs with Binance topping the list with about USD60 billion, followed by BitFinex with about USD6 billion and BitFinex with about USD4.4 billion. Do take note however, that the value of CEXs’ reserves would change from time to to time due to the fluctuations in the market value of the underlying crypto assets.

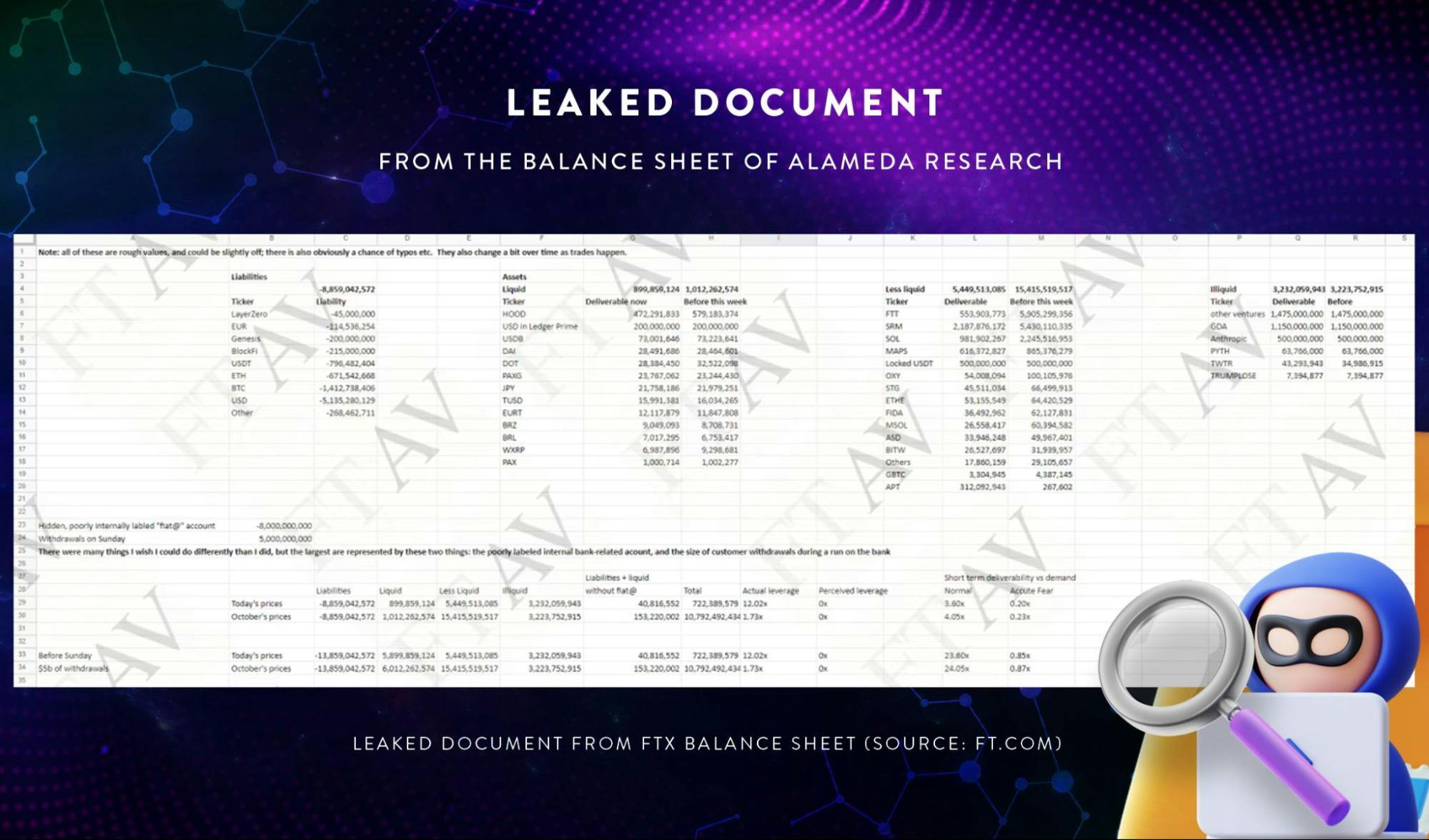

On 2 November 2022, a leaked document from the balance sheet of Alameda Research (the sister trading firm of FTX) showed it was highly overleveraged on FTT tokens which eventually culminated in the filing by FTX for bankruptcy protection on 11 November 2022.

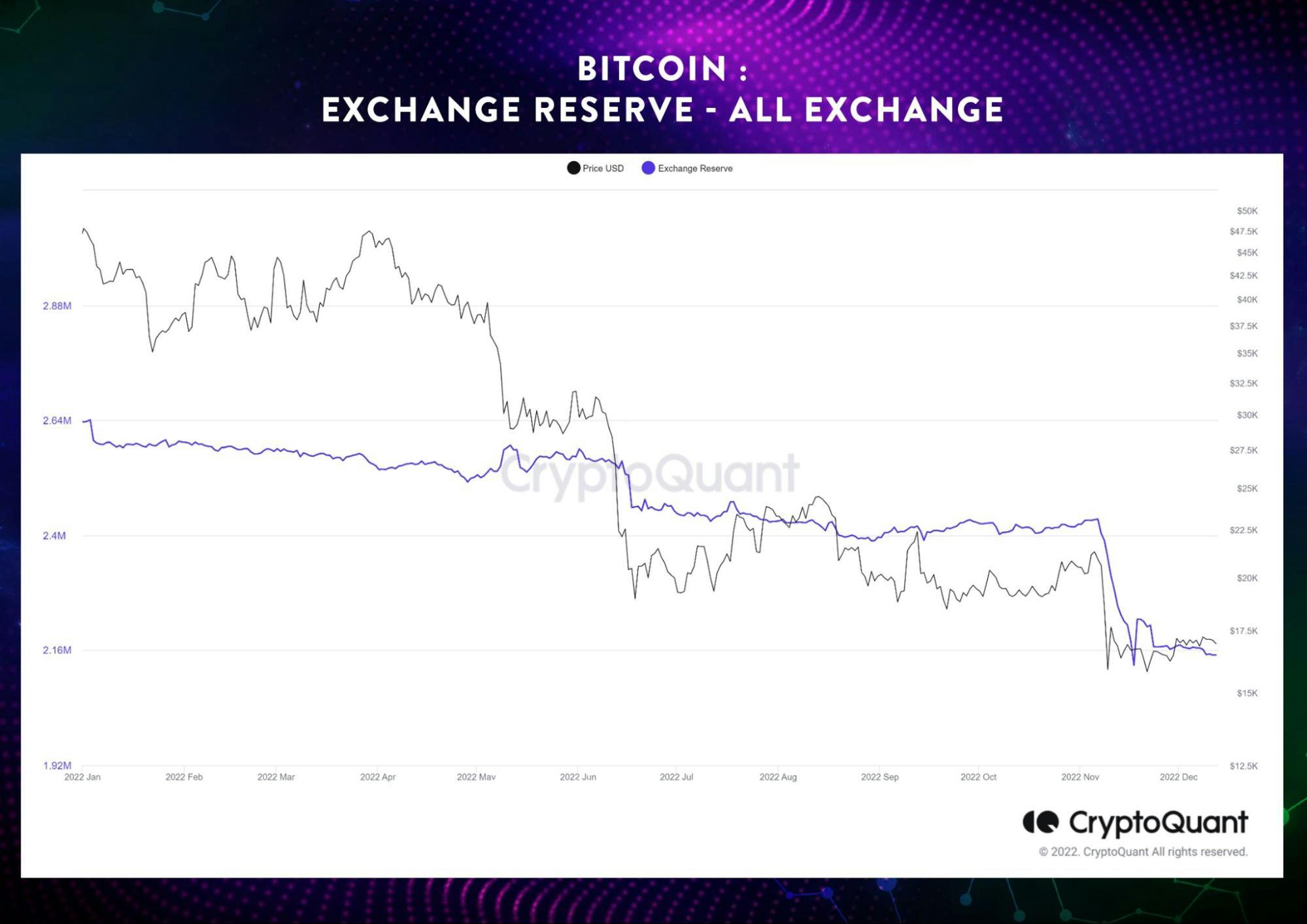

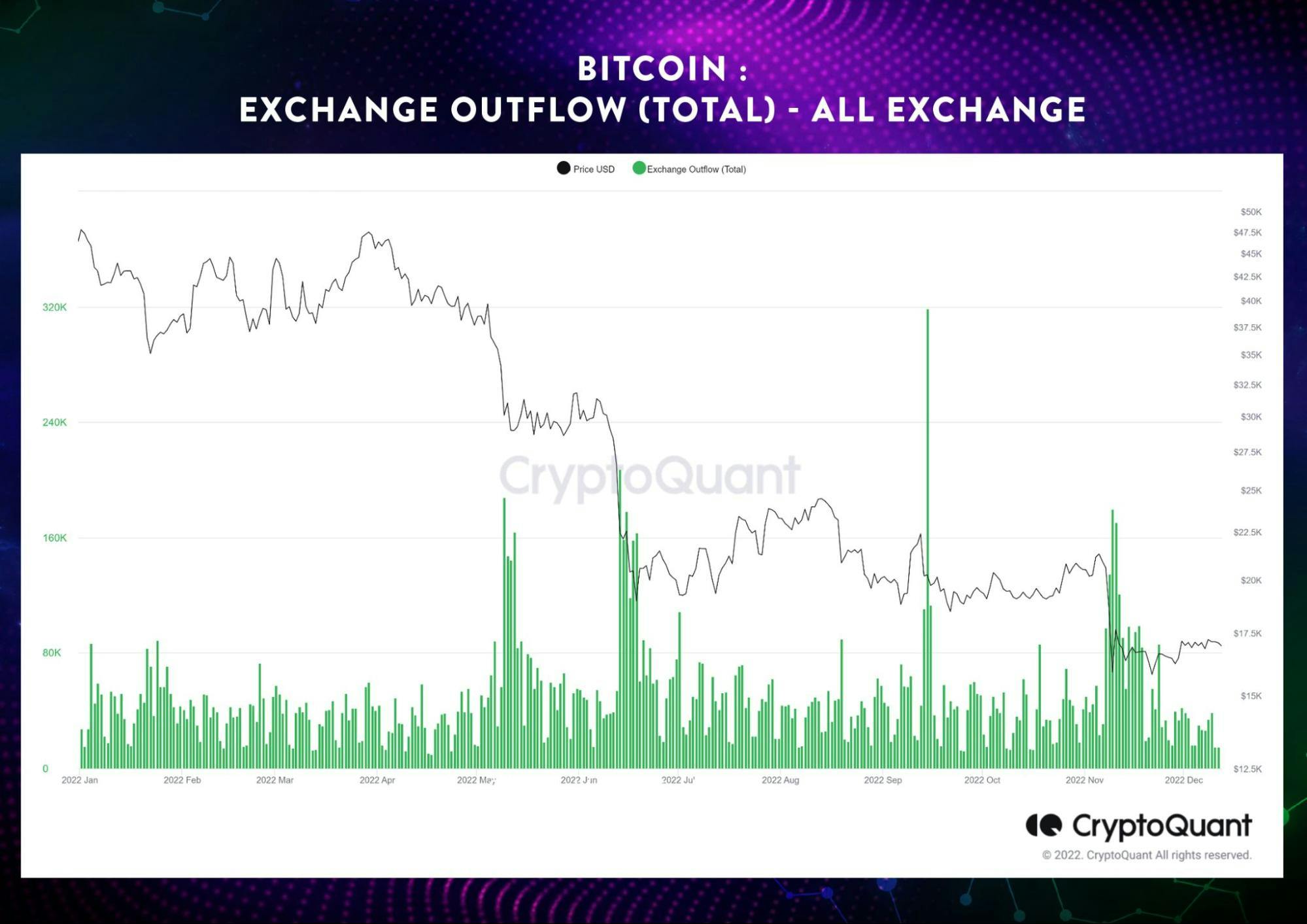

The ripple effects of the fall of FTX which previously counted itself as among the top few crypto exchanges triggered a significant outflow of Bitcoin from exchanges.

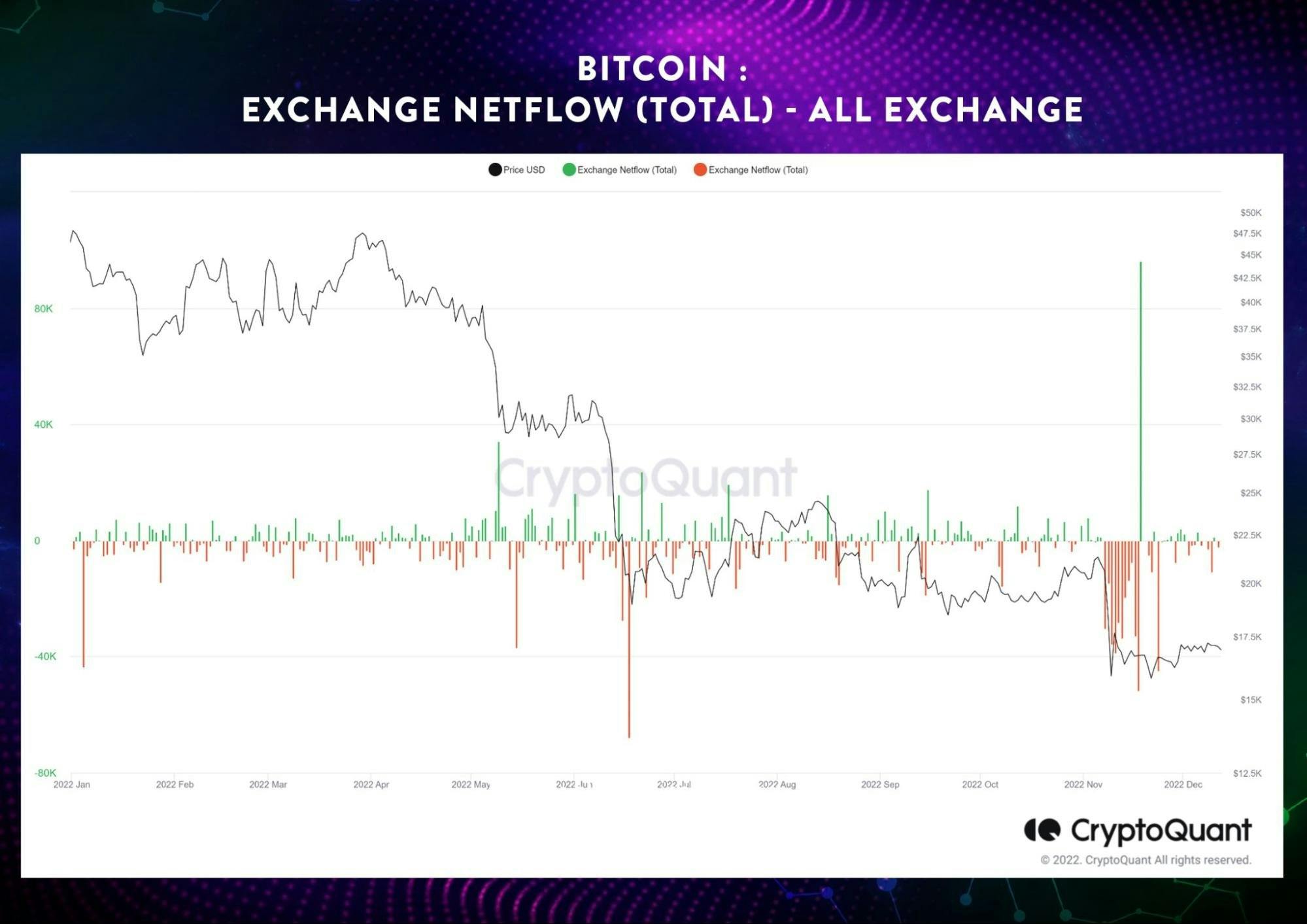

The huge outflow of Bitcoin in the aftermath of the FTX fallout resulted in a corresponding significant negative netflow of Bitcoin from exchanges.

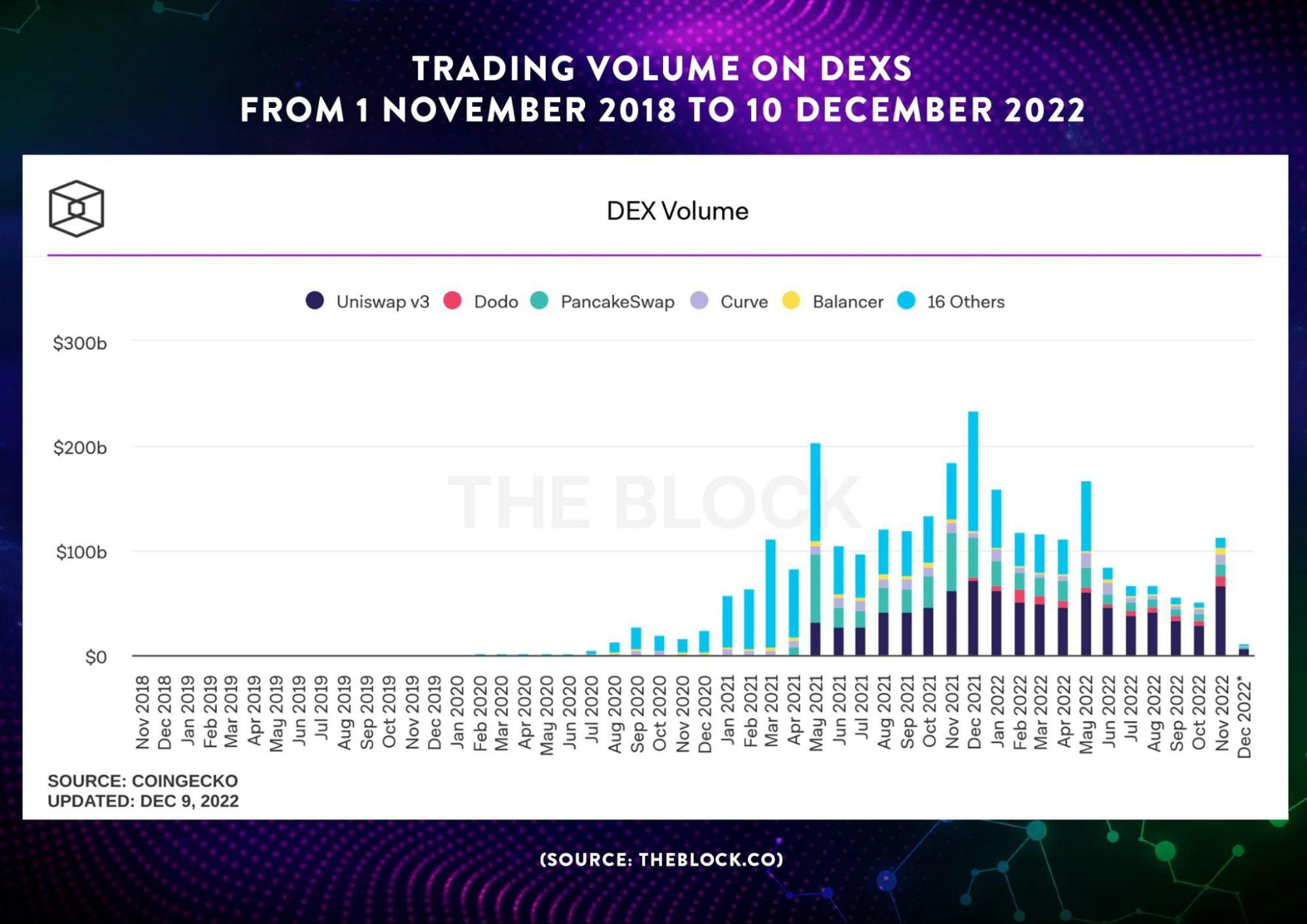

In terms of market impact, CEXs bear the brunt upon the occurrence of major events which involve their centralized peers. In May 2022 which is the month when TerraUSD collapsed, the volume of trading on DEX amounted to USD167.37 billion which is a 48% increase from the USD111.23 billion recorded in April 2022. Similarly in November 2022 which is the month the FTX fallout occurred, the volume of trading on DEX amounted to USD112.32 billion which is a 54% increase from the USD51.2 billion recorded in October 2022.

There seems to be a distinctive pattern where every time a major event happens to a centralized crypto entity, the resulting loss of trust in custodial-based crypto services such as CEXs drive crypto users towards non-custodial based crypto services such as DEXs. This pattern is reflected in the significant increase in the volume of trading on DEXs in the very same month of the occurrence of a major event affecting a centralized crypto entity.

From a commercial perspective, the introduction of PoRs is part of the efforts of CEXs to restore public trust in themselves to try to regain the market share which they have lost, and would continue to lose to DEXs every time a major event happens to one of their centralized peers. Nonetheless, it is clear that the future of crypto is a decentralized one because to quote CZ himself, “I would say maximum, in 10 years, DEXes [and] DeFi are going to be bigger than CeFi.”

The information in this article is neither intended as nor amounts to financial, tax, legal, investment, trading, or any other form of professional advice. Avocado DAO makes no representation whatsoever that the information herein is accurate, up to date, or applicable to the circumstances of any particular reader or organization.

The use of the information herein is entirely at the reader's own risk, who shall assume full responsibility for the risk of any loss or damages arising from their reliance on such information. For the avoidance of doubt, under no circumstances is Avocado DAO to be deemed as having assumed responsibility or be held liable for any loss or damages, whether financial or otherwise, arising from the reader's use of or reliance on the information herein.