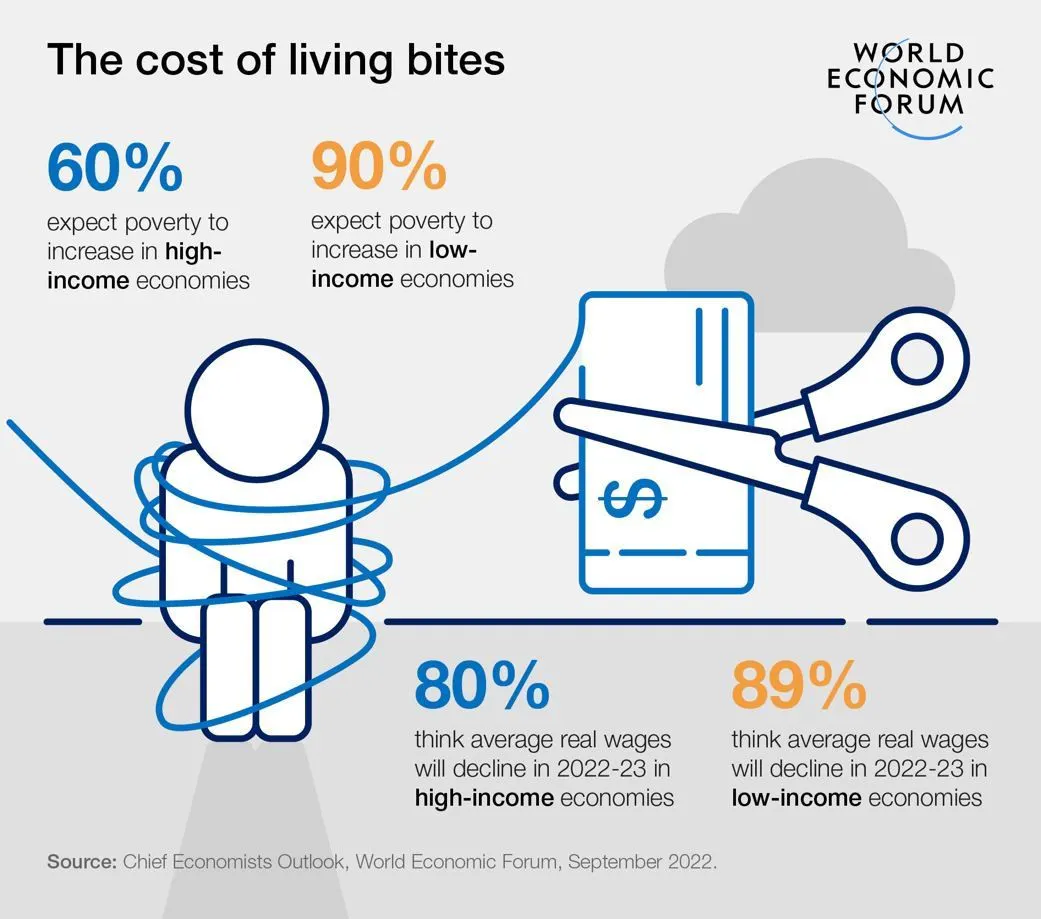

2022 has been a year of learning for humanity in general and the crypto community in particular. The persisting onslaught of the Covid-19 panndemic and Russia-Ukraine crisis continue to generate economic headwinds which threaten to slow down global growth or even reverse some of the progress made in the past few years. Based on a survey conducted by the World Economic Forum (WEF) in September 2022, most economists are of the opinion that the incessantly rising levels of global inflation is set to unleash a cost of living crisis for both high and low income countries alike.

The World Bank in its policy note titled “Is a Global Recession Imminent?” issued in September 2022 relied on insights from previous global recessions to put into perspective the current economic climate. In its study, the World Bank analyzed the recent trends in the global economy and presented plausible scenarios for 2022 to 2024 with the three key main findings of the World Bank being as follows:

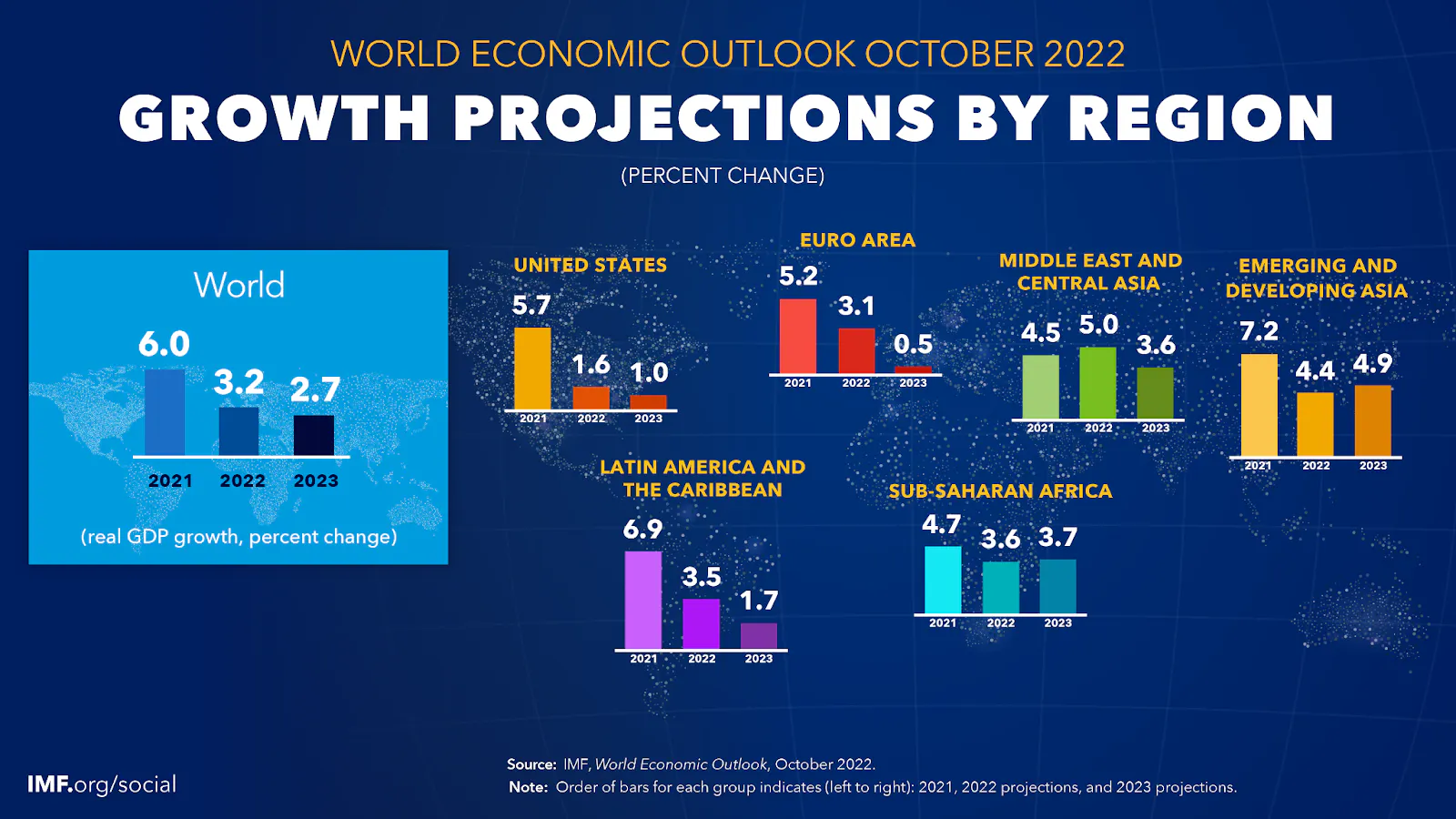

- With the International Monetary Fund (IMF) projecting that global economic growth would be slowing down by 2.8% Year-on-Year (YoY) to 3.2% in 2022 from the 6% of 2021, the World Bank is raising the red flag that “every global recession since 1970 was preceded by a significant weakening of global growth in the previous year.”

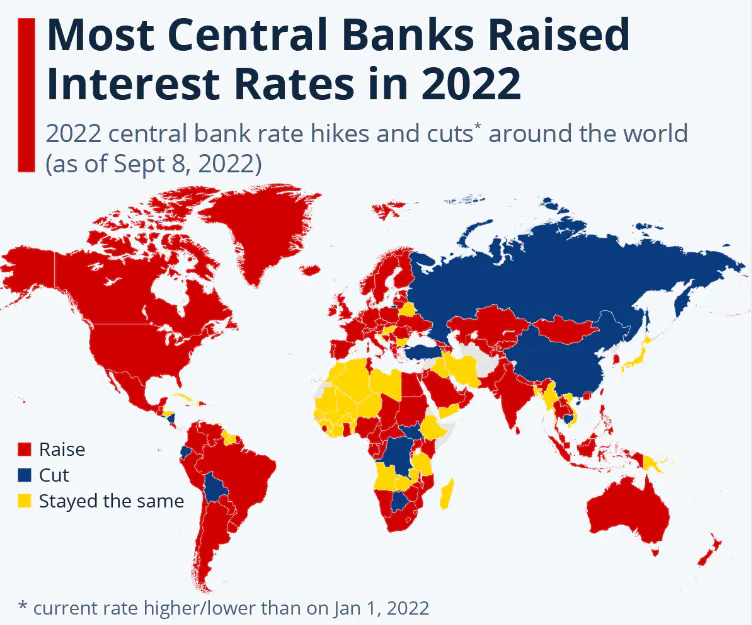

- There has been a seemingly unprecedented synchronous raising of interest rates by central banks around the world with the exception of those in Central and East Asia. Whilst this is a necessary evil to tame the rising levels of global inflation, the World Bank cautioned that “their mutually compounding effects could have larger impacts than envisioned—both in tightening financial conditions and in steepening the global growth slowdown.”

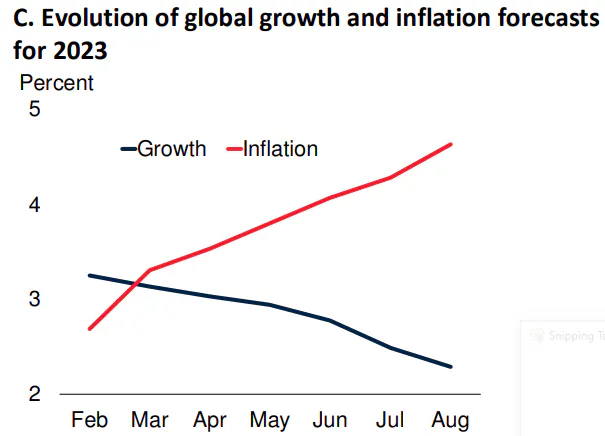

- In the event the fiscal policies tightening measures of central banks fail to reduce inflation rates to the prescribed targets, the projected inverse relationship between inflation and global growth in 2023 means that there is a high likelihood of recession next year. As the World Bank warned, “experience from previous global recessions suggests that this could cause significant financial stress and increase the likelihood of a global recession next year.”

Fair to say, things are looking rather bleak for the global economy but fret not as GameFi is here to provide a glimmer of hope. With the cost of living crisis that is set to befall both high and low income countries, the expanding community of play-to-earn (P2E) gamers could harness the financial elements of GameFi to get through the cost of living crisis particularly in view of the impending global recession.

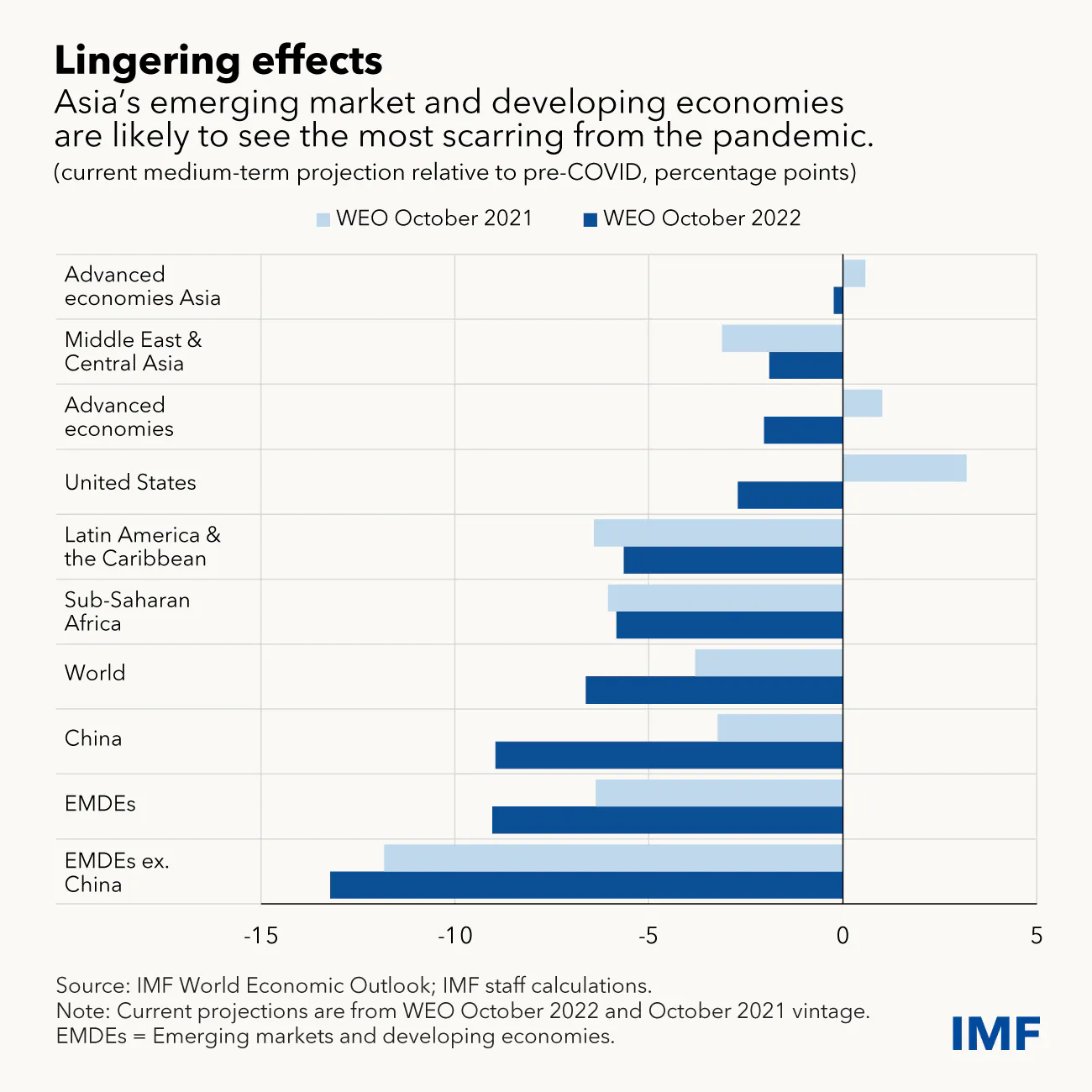

Regardless of whether the global economy enters into a state of recession in 2023, the prevalent economic headwinds from the double whammy of the Covid-19 pandemic and the Russia-Ukraine crisis are set to throw Asia’s economy into a tailspin. With regard to the Covid-19 pandemic, the IMF expects Asia’s emerging markets and developing economies (EMDEs) which include countries such as China, India, Indonesia, Malaysia, Thailand, the Philippines and Vietnam to suffer the most in terms of the aftereffects of the pandemic. Based on the IMF’s estimations, the collective GDP of Asia’s EMDEs is set to contract by about 9 percentage points in the medium term commencing from October 2022.

Nonetheless, the digital savior that is the Metaverse is set to save the day for Asian economies. Global financial audit firm, Deloitte in its report titled “The Metaverse in Asia Strategies for Accelerating Economic Impact” has projected that Metaverse-related industries are set to contribute between USD800 to USD1,400 billion to Asian economies by 2035, accounting for roughly 1.3 – 2.4% of the continent’s overall GDP. In this manner, the Metaverse would be giving Asian economies a massive shot in the arm to help them mitigate the prolonged aftereffects of the impending global recession.

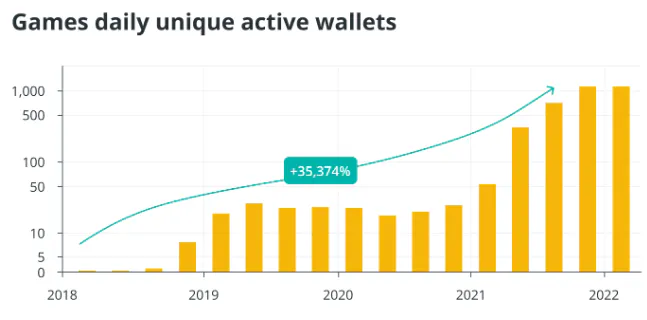

As one of the key onboarding points to the Metaverse, the GameFi market would be playing a crucial role in supporting the realization of the full potential of Metaverse in Asia. The coming to the fore of the Metaverse in Asia could be the continent’s trillion dollar ticket out of the ravages of the impending global recession. With the Southeast Asia (SEA)'s digital boom having paved the way for its skyrocketing Internet connectivity and electronic devices ownership rate, this region is set to be GameFi hub in the Asian Metaverse.

Better still, GameFi would be giving the lower income groups from low and middle income countries (LMICs) in Asia particular those from SEA some respite from the sky-high global inflation rate that is projected to be at a staggering 8.8% in 2022 which is an 87% YoY increase from the rate of 4.7% recorded in 2021. This is because P2E gamers from LMICs such as Bangladesh, India, Indonesia, Malaysia and the Philippines now have the option of using their GameFi token earnings to settle their utility bills through XLD Finance’s xSpend platform. This would help ease the cost of living burden of GameFi players from these countries particularly those from lower income groups.

Taken together, the projections of the World Bank, IMF and WEF paint a rather despondent picture of the global economic outlook for 2023. Nonetheless, it is not all doom and gloom as GameFi through its role as a key onboarding point to the Metaverse as well as the availability of the option for utility payment for selected LMICs in Asia is paving the way for the deployment of gamification as a solution to mitigate the effects of the global cost of living crisis. This functional role of gamification could be of critical importance in view of the fact that this crisis could be made all the worse if the much dreaded global economic recession befalls us in the year ahead.