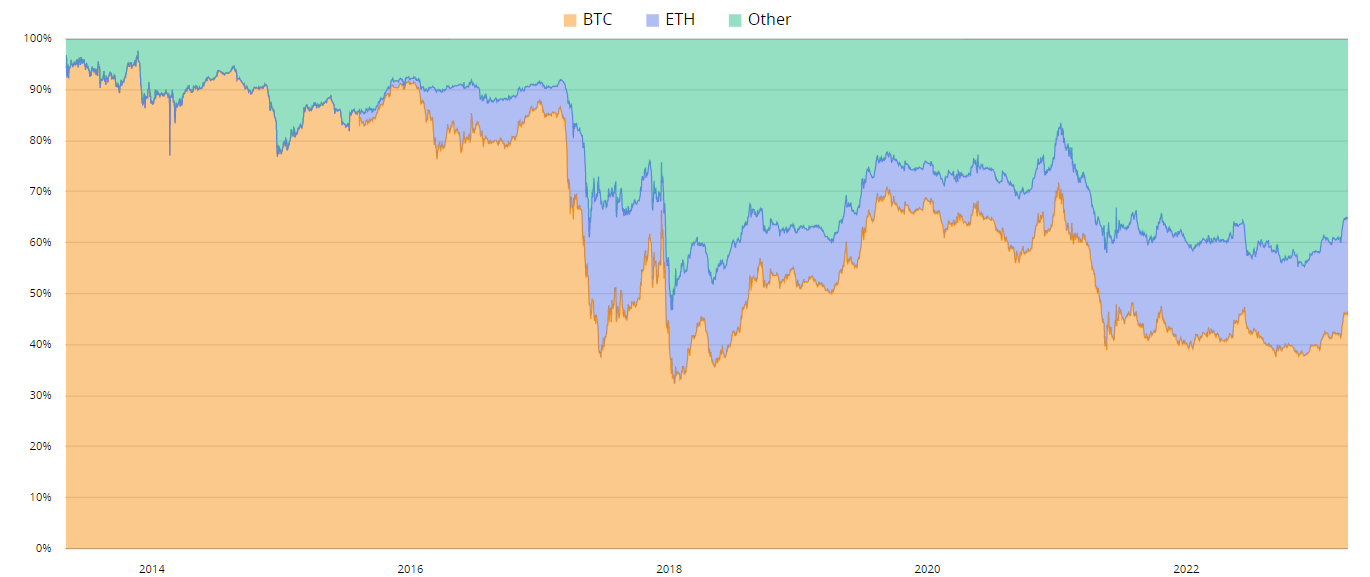

Welcome to our first Ethereum course, join us as we learn everything you need to know about the Shanghai Capella upgrade. As the very first cryptocurrency, Bitcoin led the way for the approximately 23,000 altcoins that we have as at the time of writing in mid-April 2023. One of these altcoins is Ethereum. Over the past few years, Ethereum has been gradually reducing Bitcoin's market dominance particularly with the execution of the Shanghai Capella upgrade.

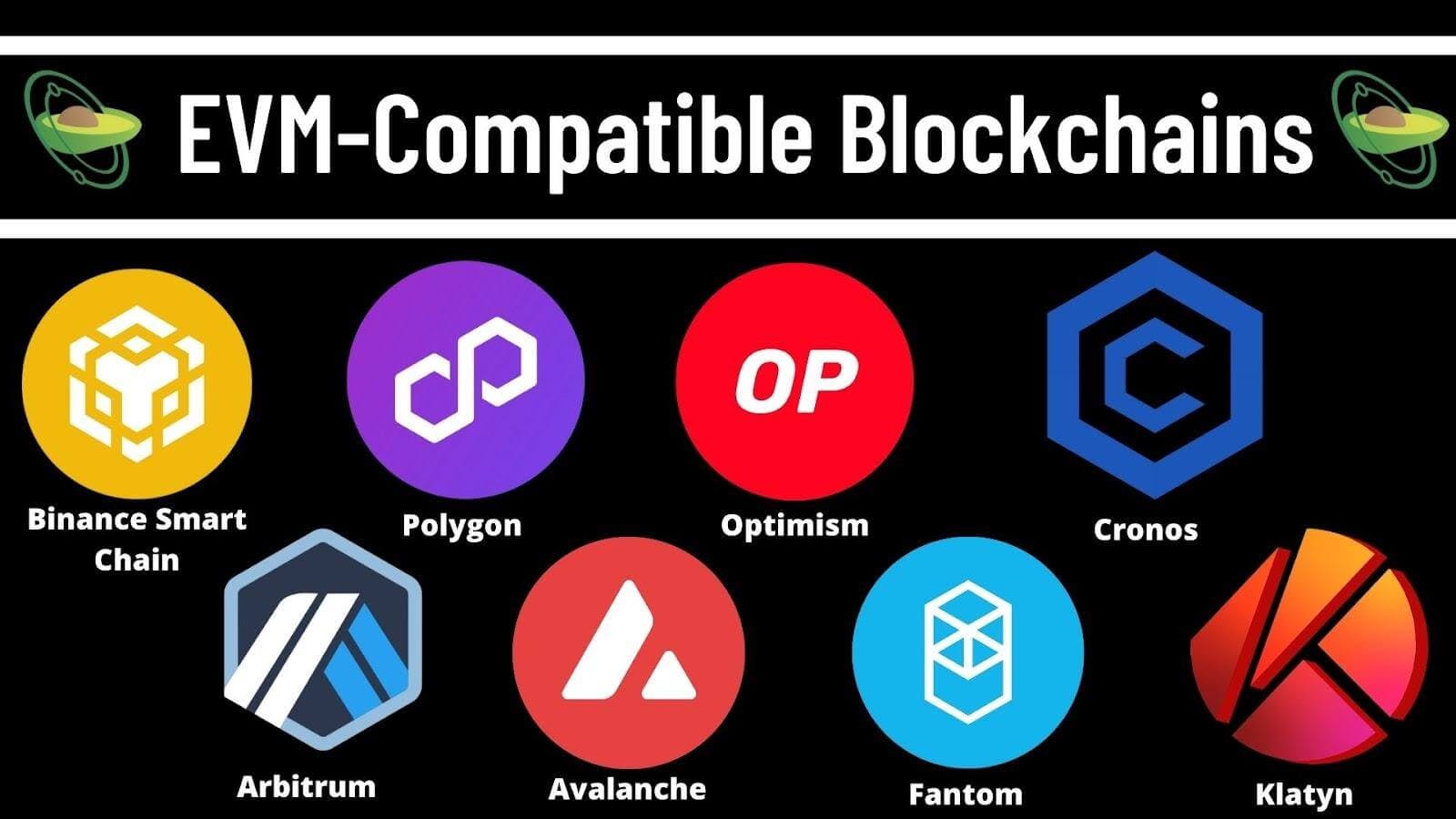

In contrast with Bitcoin whose main functions are as a payment and investment instrument. Ethereum has the extra feature of programmability. This is why Bitcoin is dubbed as digital gold, whereas Ethereum is referred to as digital silver, albeit one which functions as the electricity of the crypto universe. A case in point is the host of Ethereum Virtual Machine (EVM)-compatible blockchains as below which would be boosted by the Shanghai Capella upgrade.

The sheer utility of EVM is the hallmark of Ethereum's success story. As for Bitcoin, its high watermark is its recognition as store of value and legal tender in the Central African Republic and El Salvador, and its acceptance as a means of payment by more than 15,000 businesses worldwide.

Ethereum Network’s Achilles HeelsNotwithstanding its strengths, the Ethereum network has a few Achilles heels, notably its high energy consumption, gas fees, and low transaction speed. The effects of these disadvantages on users of the Ethereum network are as below.

- High Energy Consumption

Reduces the network's environmental friendliness, resulting in more distinct carbon footprints for users.

- High Gas Fees

Lowers the network’s cost efficiency, resulting in high transaction costs for users.

- Low Transaction Speed

Increases the network’s processing time, resulting in longer waits for confirmation of transactions for users.

Cumulatively, these Achilles heels of the Ethereum network elevate the network’s barriers to entry and reduce its overall quality of user experience (UX). Fret not, however, as the visionary Vitalik Buterin has incorporated various upgrades in Ethereum's roadmap, primarily of which is The Merge as well as the Shanghai Capella upgrade, to address the network's pain points.

The Merge: The Birth of Ethereum 2.0Ethereum's shift to Proof-of-Stake (PoS) through the Merge which was the last major update prior to the Shanghai Capella upgrade paved the way for the network to be a green blockchain. In contrast with Proof-of-Work (PoW) which requires vast amount of electricity due to its need for extensive computational power, PoS's computations are much less energy intensive.

As for Ethereum network's issues of transaction cost and speed, they will be addressed in the future with implementation of zk-rollups and zero-knowledge proof (ZKP) in the next major update after the Shanghai Capella upgrade. The benefits from The Merge as well as the future use of zk-rollups and ZKP for users of the Ethereum network are as below.

- Lower Carbon Footprints

The shift to the less energy-intensive PoS consensus mechanism reduces the energy consumption of the Ethereum network by ~99.95%. For users, this would mean much less distinct carbon footprints.

- Lower Transaction Costs

The future use of zk-rollups and ZKP to bundle multiple transactions into a single transaction that is processed in one go elevates cost efficiency would reduce gas fees by up to 200x on the Ethereum network. For users, this would mean lower transaction costs.

- Shorter Waiting Time

The future use of zk-rollups and ZKP to process bundled transactions off-chain would boost the latency (time required for end-to-end data transmission) and throughput (speed of data transmission) of the Ethereum network. For users, this would mean higher transactional speeds and shorter waiting times for confirmation of transactions.

Having shifted to the PoS consensus mechanism post-The Merge, the Ethereum network is fully secured by staked Ether (ETH). The available staking options for ETH holders are as below.

- Solo Staking

The minimum deposit requirement for solo staking is 32 ETH. Solo stakers must maintain Internet-connected hardware that runs both an Ethereum execution client (which are like workers who perform specific tasks and actions) and consensus client (which are like managers who ensure that the workers follow the rules). Other than the loss of staked ETH, the risks of solo staking include the imposition of penalties if a solo staker’s hardware goes offline.

- Staking-as-a-Service (SaaS)

Similar to solo staking, the minimum deposit requirement for SaaS staking is 32 ETH. SaaS stakers are required to generate their keys before storing them safely. In addition to the risks of solo staking, SaaS staking has an additional risk element in the form of counter-party service provider risks.

- Pooled Staking

Pooled staking is the most accessible ETH staking option, with some projects merely requiring 0.1 ETH. The risks of pooled staking vary depending on the particular method used.

The protocol rules of the Ethereum network are such that ETH stakers are not allowed to withdraw their staked ETH and ETH rewards. After the execution of the Shanghai Capella upgrade, it is now possible for withdrawals of staked ETH to be made through the options below.

- Partial Withdrawal

Through this option, ETH stakers can withdraw their accumulated ETH rewards. The withdrawal can be undertaken with immediate effect.

- Full Withdrawal

Through this option, ETH stakers can withdraw both their staked deposit and accumulated ETH rewards. The withdrawal takes time because the validator needs to transmit a message to the Ethereum network to add itself to the exit queue.

The community sentiments around the Shanghai Capella upgrade indicate that the community expects more ETH staking after the execution of the upgrade. This would drive up demand for ETH which has led to projections that the Shanghai Capella upgrade could be driving Ether (ETH) to a new record high by the end of 2023. Only time will tell.

ConclusionWhile Bitcoin continues to be the main barometer of the crypto market, Ethereum with its Ether is giving Bitcoin a run for its money as the top cryptocurrency. If Ethereum is to take over the crypto mantle from Bitcoin, it would have to first fulfil its mission to solve blockchain's scalability trilemma through its lates update in the form of the Shanghai Capella upgrade.

Now that you have learnt almost everything you need to know about the Shanghai Capella upgrade, you can put your knowledge to the test at our Questing Portal. Learn more about how Ethereum is taking on the scalability trilemma post-execution of the Shanghai Capella upgrade without compromising on the privacy of Web3 users in our next course, "Scaling Up the Ethereum Virtual Machine (EVM) with ZKP."

The information in this article is neither intended as nor amounts to financial, tax, legal, investment, trading, or any other form of professional advice. Avocado DAO makes no representation whatsoever that the information herein is accurate, up to date, or applicable to the circumstances of any particular reader or organization.

The use of the information herein is entirely at the reader's own risk, who shall assume full responsibility for the risk of any loss or damages arising from their reliance on such information. For the avoidance of doubt, under no circumstances is Avocado DAO to be deemed as having assumed responsibility or be held liable for any loss or damages, whether financial or otherwise, arising from the reader's use of or reliance on the information herein.